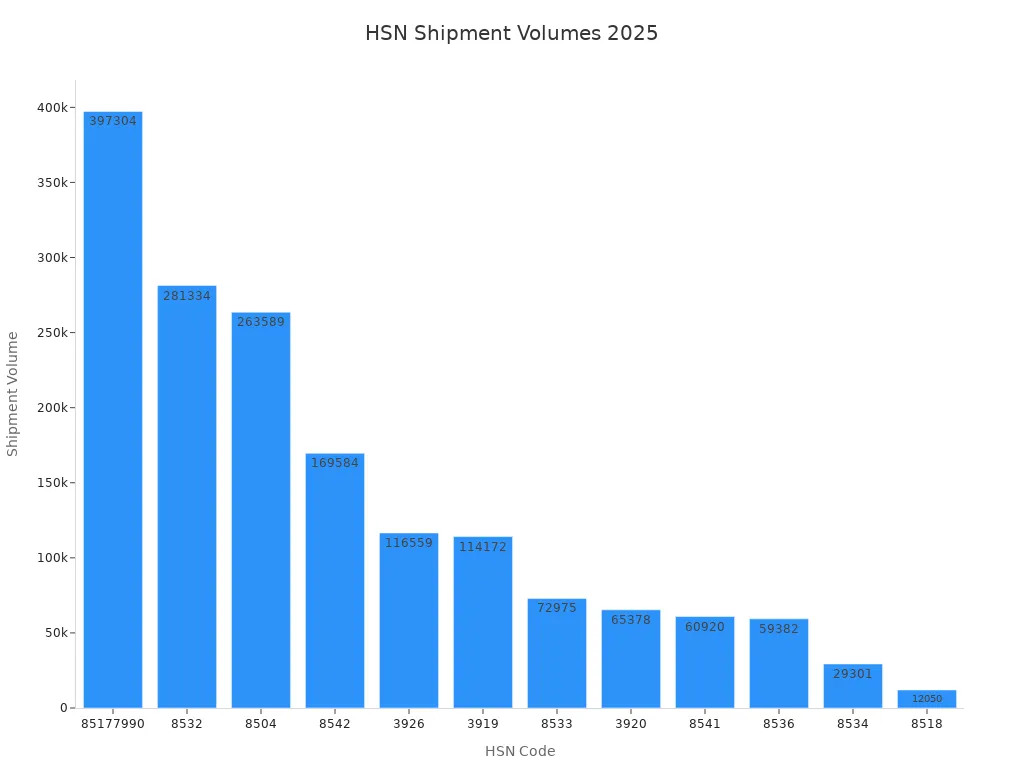

A good understanding of important HSN codes like 85322990, 85340000, 85177910, and 8542 is very important for people in electronics. Using the correct hsn code helps you follow GST rules. It also helps you know what taxes to pay. This makes trading with other countries easier under the harmonised system code. In 2025, the top hsn categories have a lot of shipments:

HSN Code | Shipment Volume (2025) | Description/Notes |

|---|---|---|

85177990 | Mobile phone parts imports in India | |

8532 | 281,334 | Related HSN chapter 85 code |

8504 | 263,589 | Other related parts |

8542 | 169,584 | Other related parts |

8541 | 60,920 | Diodes, other than photosensitive or light emitting diodes |

8534 | 29,301 | Printed circuits |

Choosing the right hsn classification affects many shipments and buyers around the world. The pcba hsn code helps make trade reports correct. It also lowers the risk of breaking rules for electronic makers.

Key Takeaways

Using the right HSN code helps electronics companies follow tax and customs rules, avoid fines, and speed up shipments.

PCBA means a loaded circuit board with parts, while PCB is just the bare board; each needs different HSN codes.

Common HSN codes like 85177010 for loaded boards and 85340000 for bare boards help classify products correctly.

Companies should follow clear steps to pick the right HSN code, keep records, train staff, and use smart tools to avoid mistakes.

Staying updated on HSN code changes through official sources keeps businesses compliant and trade smooth.

HSN Code Basics

What Is HSN?

The harmonized system of nomenclature, or HSN, is used worldwide. It helps people sort and group products for trade. The World Customs Organization made this system in 1988. They wanted everyone to use the same way to name products. Now, almost every country uses HSN to organize goods by their features. This makes it easier for businesses and governments to talk about products. It also helps make trading between countries smoother.

HSN codes have six numbers. The first two numbers show the chapter. The next two numbers tell the heading. The last two numbers show the subheading. For example, chapters 01 to 05 are for animal products. Codes like 0101.10 are for pure-bred breeding animals. This setup makes it easy to find and sort products. Over time, the harmonized system of nomenclature has changed to fit new technology and trade. Because of this, it is still a good tool for customs, taxes, and following rules.

Note: HSN codes make customs work easier, help keep data correct, and help all kinds of businesses work better.

Why HSN Codes Matter

HSN codes are very important in electronics. They help companies put products in the right group. This is needed for GST checks and customs. If an electronics business sells a lot, it must use the right hsn code for GST. This rule makes the business look more trustworthy and helps with taxes.

Using the right hsn code stops mistakes and big fines. Studies say that 15% of customs problems come from wrong HS codes. From 2020 to 2024, trade fines were $5.3 billion because of wrong codes. Companies that use the right hsn code save money and do not have late shipments. They can also do better than others by 15% if they follow the rules.

Using the right hsn code helps set the right tariffs and stops paying too much.

It helps shipments move faster and keeps supply chains smooth.

Good product codes make it harder for fraud and trade mistakes to happen.

New research shows that trade mistakes often come from wrong codes and fraud. This happens when companies try to skip rules. Using the right hsn code lowers these risks and helps fair trade. In electronics, things change fast. Keeping up with the harmonized system of nomenclature helps companies follow rules and keeps their business safe.

PCBA HSN Code Overview

PCBA vs. PCB

Many people use PCB and PCBA, but they are not the same. A PCB is a flat board made from fiberglass or other stuff. It has copper lines that connect different spots. This board holds electronic parts and gives them paths for electricity. A PCB can have one side, two sides, or many layers. Making a pcb board has steps like pattern transfer, etching, and drilling. Some ways, like photolithography, make sharp details but cost more. Other ways, like screen printing, cost less but do not look as sharp. These steps are for making the plain pcb board.

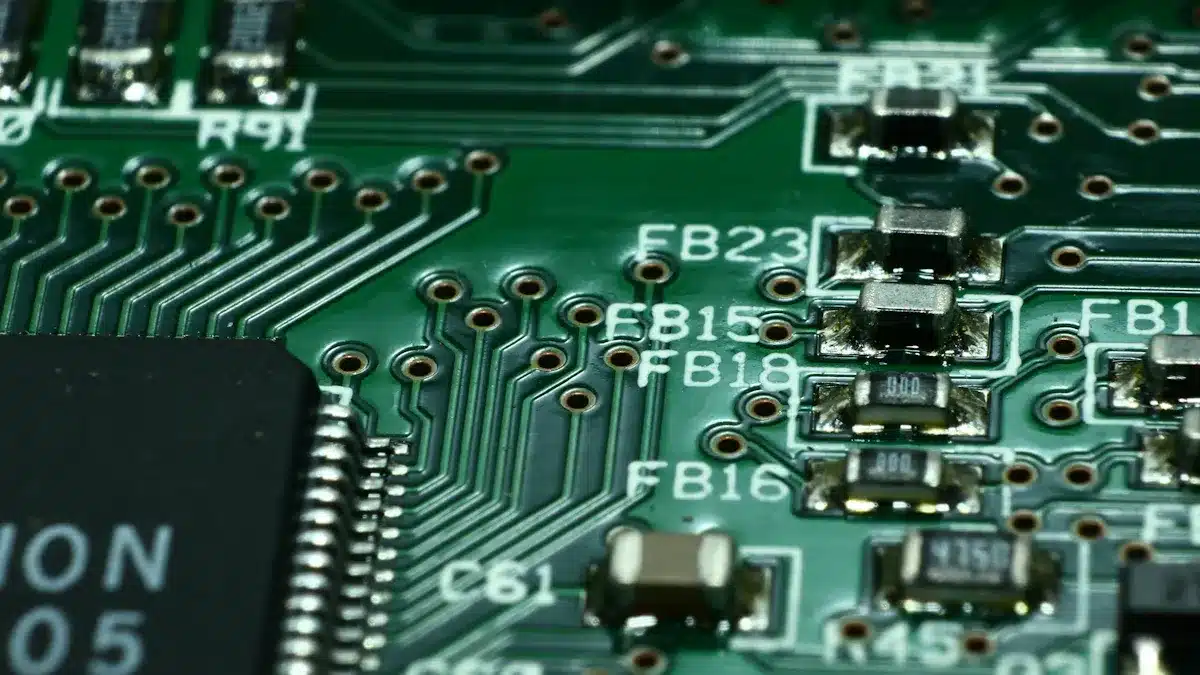

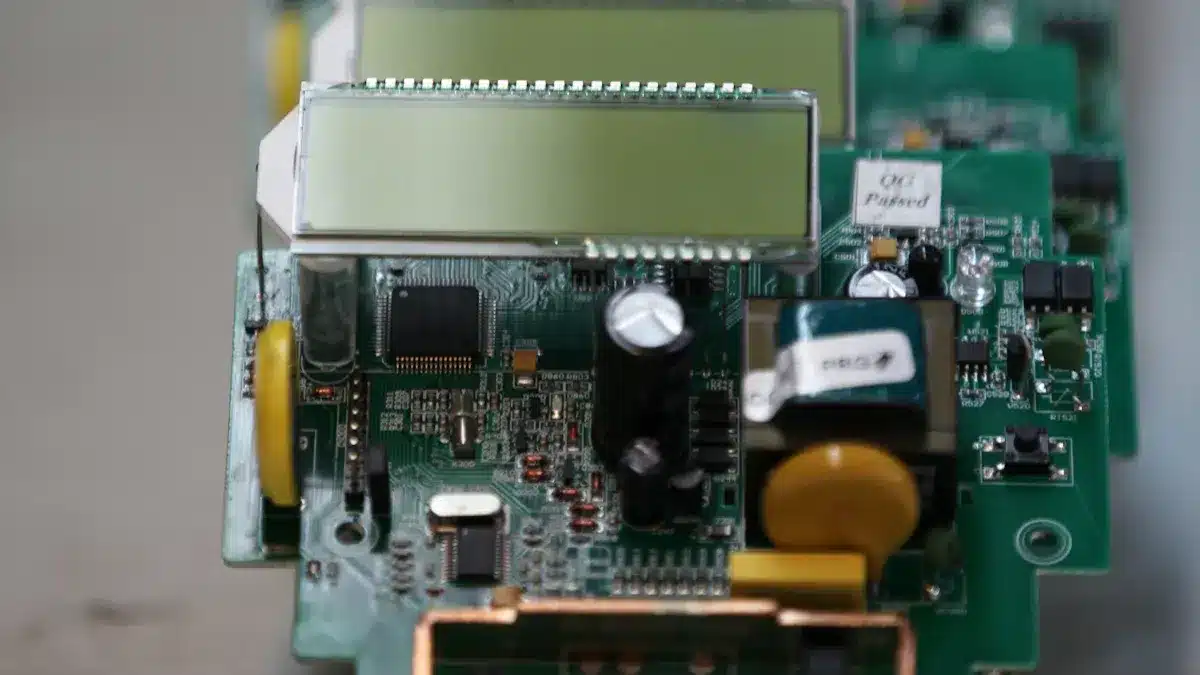

A PCBA is a pcb board with electronic parts put on it. People also call it a loaded, stuffed, or mounted pcb board. The assembly adds resistors, capacitors, chips, and other parts to the pcb board. This makes the board ready to use in gadgets. The quality of a PCBA depends on the pcb board and how it is put together. The IPC-A-600 standard helps set the quality for pcb boards. Class 2 is for normal electronics, and Class 3 is for things that need to be very reliable. These rules matter for both pcb and pcba quality.

The big difference between pcb and pcba is what they do and the problems they have. PCB groups look at how the board is made, like how many layers it has and how it is built. PCBA groups care about things like dirt and mistakes when putting parts on. For example, a loaded or stuffed pcb board can have problems from different kinds of dirt. These can cause short circuits or make the board not work well. Cleaning is more important as boards get smaller and have more parts. This is not as big a problem for plain pcb boards.

Classification Aspect | PCB Characteristics | PCBA Characteristics | Market Segmentation Examples |

|---|---|---|---|

Definition | Bare boards with conductive layers (single-sided, double-sided, multi-layer) | Fully assembled boards with components soldered onto PCB, functional electronic units | Types: Rigid 1-2 sided, Standard Multilayer, HDI/Microvia/Build-Up, IC Substrate, Flexible Circuits, Rigid Flex |

Application | Mechanical support and electrical connection of components | Ready-to-use electronic assemblies | Applications: Consumer Electronics, Computer, Communications, Industrial/Medical, Automotive, Military/Aerospace |

Market Size & Growth | Part of overall PCB & PCBA market valued at USD 67.65 Billion in 2024, projected to reach USD 85.88 Billion by 2032 with CAGR 3.34% | Same as PCB, as PCBA includes PCB plus assembly | Growth driven by communication, automotive, miniaturization, green PCB development |

Quality Standards | IPC-A-600 Class 2 vs Class 3 standards relevant to PCB quality and indirectly to PCBA | Quality standards impact assembly reliability and application suitability | – |

Note: The difference between pcb and pcba changes how companies use hsn codes. A loaded, stuffed, or mounted pcb board needs a different hsn code than a plain pcb board.

Common PCBA HSN Codes

Picking the right pcba hsn code is important for every electronics company. The hsn code helps customs and tax workers know what is being shipped. It also helps companies pay the right taxes and not have delays. Reports show that using the correct pcba hsn code makes customs checks faster and trade easier. It also helps governments get the right trade numbers.

The Harmonized System gives different hsn codes for plain pcb boards and for loaded, stuffed, or mounted boards. Plain pcb boards are under heading 8534. Loaded, stuffed, or mounted boards, called PCBA, are under heading 8517. The pcba hsn code can also show if the board is stiff, bendy, or has many layers. For example, a loaded pcb board with many layers will have a different hsn code than a single-layer board. Import hsn codes often have more details than export codes. This helps customs set the right fees.

Here are some of the most common pcba hsn codes used in 2025:

85177010: Used for loaded, stuffed, or mounted pcb boards for telecommunication equipment.

85177090: Used for other loaded, stuffed, or mounted pcb boards not covered by 85177010.

85340000: Used for plain pcb boards, not loaded or stuffed.

85369000: Used for other electrical things for switching or protecting electrical circuits, which can include some loaded pcb boards.

85423100: Used for mounted or loaded integrated circuits, often found on pcba.

A company must check the product details before picking a pcba hsn code. The right hsn code depends on the type of pcb board, how many layers it has, and if it is loaded, stuffed, or mounted. Using the wrong hsn code can cause customs delays or extra costs. Companies should look at their product list and match each item to the right pcba hsn code.

Tip: Always update the pcba hsn code list when new products or technology come out. This helps keep trade easy and stops problems with customs.

Printed Circuit Board HSN Codes

Printed circuit board HSN codes are very important in electronics. These codes help companies sort products for customs and taxes. Using the right code lets goods move easily and reports stay correct. The industry puts printed circuit boards into two groups: bare and populated. Each group has its own HSN codes and rules.

Bare PCB Codes

A bare printed circuit board is flat and has no parts on it. It has copper lines but no electronic pieces. Makers use these boards to build all kinds of electronics. The HSN code for bare PCB boards is usually 85340000. This code is for printed circuits that do not have any parts yet.

The world market for bare PCB boards is getting bigger. In 2021, electronics making was worth USD 481.3 billion. Experts think this will grow by 10.5% each year. By 2030, it could reach USD 1158.6 billion. Companies now make products in more countries, not just China. This makes more competition and means better bare PCB boards are needed.

Aspect | Evidence / Data |

|---|---|

Global electronics manufacturing market size (2021) | USD 481.3 billion |

Annual growth rate | 10.5% |

Projected market size (2030) | USD 1158.6 billion |

Market distribution trend | Increasing global distribution beyond China, raising competitive pressure |

Industry focus | High-precision, automated inspection systems aligned with Industry 4.0 and Smart Manufacturing Systems (SMS) |

Quality trend | Adoption of Zero Defects Manufacturing (ZDM) to minimize faults |

PCB manufacturing stages | Bare PCB (BPCB) and PCB assembly (PCBA) |

Inspection evolution | From manual visual and electrical tests to automated optical inspection (AOI) and AI-based methods |

AOI advantages | Fast, non-destructive, capable of detecting almost all defect types |

Makers now use machines and AI to check bare PCB boards. These tools find almost every problem fast and do not hurt the board. The industry also wants zero defects. This means fewer mistakes and better boards. Companies that use the right HSN code for bare PCB boards can meet world rules and avoid customs delays.

Tip: Always check the HSN code for each bare PCB board before you ship. This step stops costly mistakes and helps follow trade rules.

Populated PCB Codes

A populated printed circuit board has all its electronic parts on it. These boards are also called mounted or assembled PCB boards. The HSN codes for these boards are often 85177010, 85177090, and 85423100. These codes cover many products, from simple gadgets to big machines.

Populated PCB codes matter more as electronics get harder to make. Machines like In-Circuit Testing (ICT) and Automated Optical Inspection (AOI) are now very important. These systems find problems and check if boards work. They help with populated PCB codes in big factories.

Machines like ICT and AOI find problems fast and check if boards work. These tools are needed for handling populated PCB codes in big factories.

Machine learning and smart data help test PCBA better. These tools find problems and help fix them before they get worse. This makes populated PCB codes important for good products.

Commands like SCPI help machines work faster and make tests the same every time. This makes making and checking populated PCB boards easier.

Machines now check boards instead of people. This change means fewer mistakes and better results. It helps with the hard work of checking modern populated printed circuit boards.

Design for Test (DFT) and new test machines, like flying probe testers, check every part of the board. These tools check complex boards without needing special tools.

Smaller parts and high-density interconnect (HDI) make more sides on PCB boards. These changes need special populated PCB codes for tricky circuits. Cars, factories, and home gadgets all need good codes for strong signals, heat control, and lasting parts.

Multi-sided PCB boards let more parts fit and work better. Populated PCB codes are needed for these new electronics.

More IoT, electric cars, and smart factories mean we need strong populated PCB codes. These codes help new electronic systems work well.

Asia, mostly China and Taiwan, makes most of the hard populated PCB boards. These places have lower costs and skilled workers, so they lead the world market.

Note: Companies must keep their HSN code lists up to date as new products and tech come out. Sorting populated and mounted printed circuit boards the right way helps follow rules and keeps trade easy.

HSN Code List for Electronic Components

Integrated Circuits

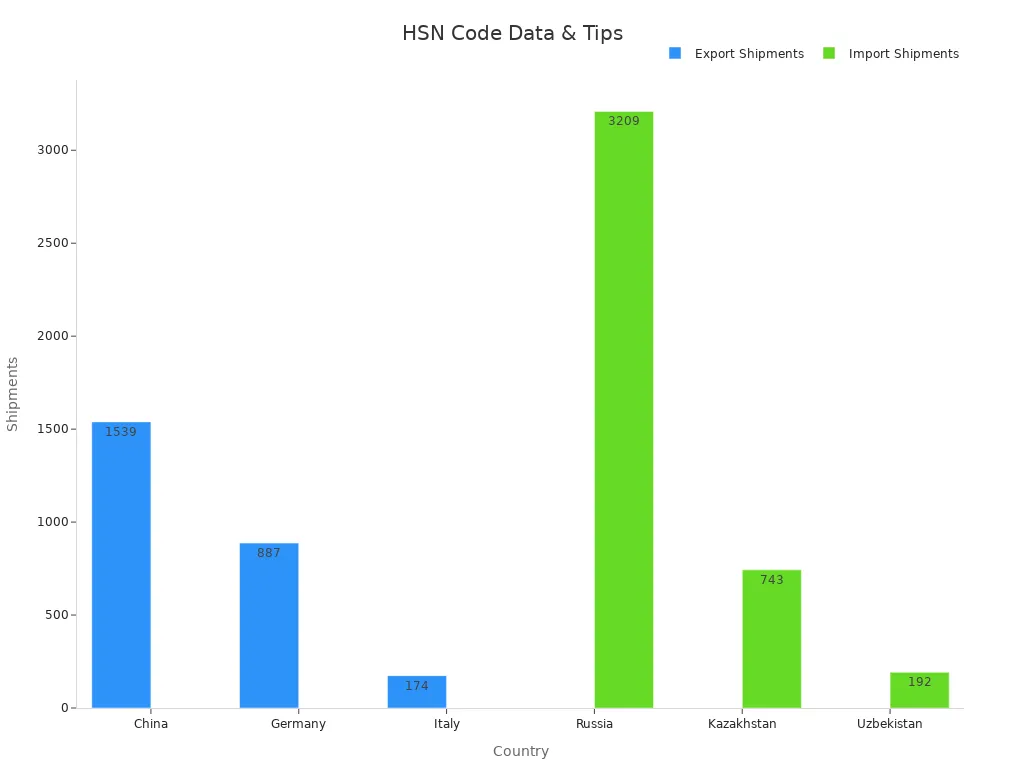

Integrated circuits are very important in today’s electronics. HSN codes help companies sort these parts for customs and taxes. The code 85423100 is for electronic integrated circuits. This includes microprocessors and controllers. People everywhere use this code to track shipments and set tariffs. The first six numbers of the HSN code are the same in all countries. Some countries add more numbers for extra details. Sorting parts correctly helps companies avoid legal trouble. It also makes importing and exporting easier. Vietnam, China, and South Korea ship the most integrated circuits with HSN code 85423900. Their shipment numbers are 90,341, 46,997, and 22,793. This shows how important it is to use the right HSN code in global trade.

Country | HSN Code | Shipments |

|---|---|---|

Vietnam | 85423900 | 90,341 |

China | 85423900 | 46,997 |

South Korea | 85423900 | 22,793 |

Semiconductors and Diodes

Semiconductors and diodes are needed for many electronics. HSN code 854110 is for diodes that do not give off light. This code is part of Chapter 85 for electrical machines and equipment. In Burkina Faso, the duty rate for this code is 10%. China uses this code system too. This makes it easy to sort and track electronic parts in trade. Other systems, like SITC and NAICS, also help the HSN system. For example, SITC 77631 is for diodes. NAICS 334413 is for making semiconductors.

Classification System | Code | Description |

|---|---|---|

SITC | 77631 | Diodes, not photosensitive nor light emitting diodes |

NAICS | 334413 | Semiconductor and Related Device Manufacturing |

Connectors and Sockets

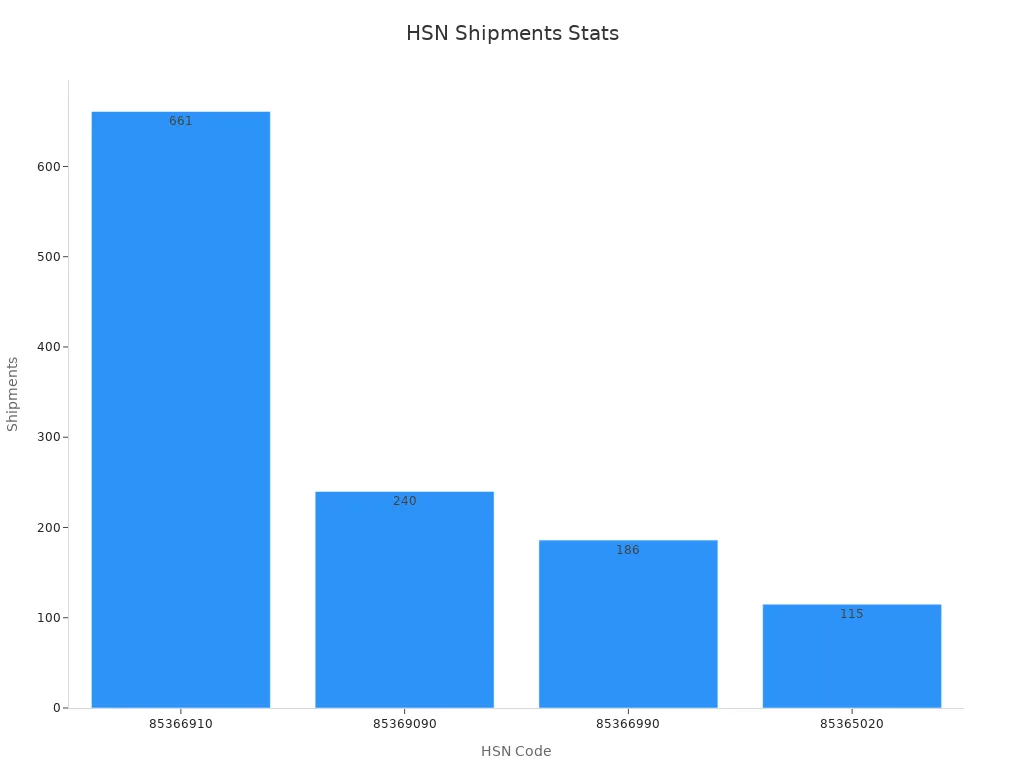

Connectors and sockets join electronic parts together. The HSN code system has many codes for these items. For example, 85366910 is for universal sockets. Code 85369090 is for other connectors. The Asia-Pacific area leads in making plugs and sockets. This is because factories are growing fast there. Shipment data shows 85366910 had 661 shipments. Code 85369090 had 240 shipments. These numbers show why using the right HSN code is important in electronics.

HSN Code | Description | Shipments |

|---|---|---|

85366910 | Universal Socket Silver (10A 4GANG 1W SWITCH UNIVERSAL SOCKET etc.) | 661 |

85369090 | Universal Socket 6 & 16 Amp | 240 |

85366990 | Socket Heavy Plugs and Sockets of Other Materials | 186 |

85365020 | Socket 3 Pin Universal 10 Amp | 115 |

Other Electronic Parts

Many other electronic parts have their own HSN codes. For example, HSN 85444299 is for some cables and wires. There were 1,021 shipments with this code. HSN 85437099 is for other electronic parts. There were 966 shipments with this code. Picking the right HSN code changes import duty, GST, and export benefits. Companies must sort every part the right way. This helps them avoid losing money or breaking the law. The HSN system helps track parts and keeps the electronics industry following world trade rules.

Tip: Always check for new HSN code updates before shipping parts. This helps stop delays and extra costs.

Product Classification Guide

Classification Steps

Getting the right hsn code for a product is important. It helps companies not make expensive mistakes. There are steps to follow to get the right code for each product. Here is a simple way to do it:

First, learn how hsn codes are set up. Each code groups products by what they are and how they are used.

Next, describe the product in detail. Use industry rules to explain what the product does and its features.

Then, look at trusted sources for help. Ask experts or check with government offices if you are not sure about the hsn code.

Always write down how you picked the code. Update your records if the product changes.

Check your codes often. If the product or trade rules change, you may need a new hsn code.

Use good habits like checking your work, teaching your team, and using smart tools to help.

One big electronics company found that looking closely at products stopped mistakes. Groups like the World Customs Organization and the U.S. International Trade Commission say these steps help companies follow world rules.

Tip: Keeping good records and checking them often helps companies follow the rules and not get fined.

Tips for Accuracy

Companies can do better with hsn codes by using these easy tips:

Teach workers often. Training helps everyone know why hsn codes matter.

Use computers and special programs. These tools help pick codes faster and make fewer mistakes.

Watch for new hsn codes and rule changes. Knowing what is new helps companies not mess up and keeps them up to date.

If a company uses the wrong hsn code, it can slow things down or cost money. Teaching workers and using new tools helps companies not have these problems.

Note: Getting hsn codes right helps goods move through customs and makes trade partners trust you.

Staying Updated on HSN

Regulatory Changes

It is very important for electronics businesses to keep up with hsn code changes. The World Customs Organization changes the HS Code system often. These changes happen because of new technology and trade updates. Companies must watch for these changes to follow the rules. Using the right hsn code helps with customs and taxes. If you use the wrong code, you might get delays or fines. Sometimes, your goods could even be taken away. Many countries add more numbers to their codes. This makes shipping between countries harder. Businesses need to know about these extra numbers to avoid trouble.

The World Customs Organization changes HS Codes to match new tech and trade.

Governments and groups use HS Codes to make trade reports and rules.

Picking the right HS Code helps with customs and keeps things safe.

Extra numbers in HS Codes mean companies must learn more than one system.

Good habits are training, asking experts, using tech, and keeping records.

Tip: If companies do these things, they can stop mistakes and keep shipments moving without problems.

Official Resources

Official resources help companies know about new hsn code changes. In India, Notification No. 78/2020, Central Tax, says all registered taxpayers must put hsn codes in their GSTR-1 tax returns. This rule makes sure people use the right hsn codes and sets how many numbers to use based on sales. The CaptainBiz blog says to check official news and sign up for customs updates. These steps help companies learn about new hsn codes and rule changes. The Mass.gov website also gives updates and reminders about hsn codes. These government papers show that changes keep happening and help companies follow the rules.

Note: Using official sources and checking for updates helps companies always use the right hsn codes for their products.

Using the right hsn code in electronics saves money and helps with customs.

Companies do not get fines or late shipments if they use the right hsn code.

Good hsn codes make the supply chain work better and help leaders make smart choices.

For instance, since April 2024, businesses making more than Rs. 5 crores must use six-digit hsn codes for B2B sales. This shows why following rules and learning new things is important.

Aspect | Details |

|---|---|

Export Shipment Data | HSN 8536: 255,545 shipments; HSN 85369090: 68,227 shipments |

Benefits of Correct HSN Usage | Sets duty rates, gives export perks, and helps with deals |

Companies should check their hsn codes often, ask experts for help, and watch for rule changes to keep up and grow.

FAQ

What is the difference between a PCB and a PCBA?

A PCB is a bare board with copper traces. A PCBA has all the electronic components mounted on the PCB.

Tip: Always check if your product is a PCB or PCBA before choosing an HSN code.

How often do HSN codes change for electronics?

HSN codes update every few years. The World Customs Organization reviews codes to match new technology.

Companies should check official updates each year.

Can one product have more than one HSN code?

No, each product should have one correct HSN code.

Using the wrong code can cause customs delays or fines.

Where can companies find the latest HSN codes?

Companies can visit government websites or the World Customs Organization site.

Resource | Website |

|---|---|

Indian Customs | |

WCO |

Why is using the correct HSN code important for GST?

The correct HSN code ensures proper GST calculation and compliance.

It helps avoid penalties.

It speeds up customs clearance.

See Also

Why HS Codes Are Crucial For PCBA Identification

A Guide To EMS And PCBA Solutions In Electronics

Exploring HS Codes Assigned To PCBs And PCBAs