India uses PCBA HS codes such as 8542.31, 85177090, and 8534.00.00. The USA uses 8534.00.00 and 8504.90.6500. Indonesia uses 84733010 and 84198913. Each country picks the PCBA HS code by its own rules. This can cause different taxes and steps to follow. People who import or export must find the right code. This helps them avoid problems at customs or money fines. Picking the right code keeps their business safe. It also helps shipments move easily between countries.

Key Takeaways

PCBA HS codes are special numbers used around the world. They help people sort printed circuit board assemblies for trade. Customs use them to set taxes and rules.

Countries like India, the USA, and Indonesia have their own PCBA HS codes. These codes change taxes, customs steps, and how fast things ship.

Using the right PCBA HS code stops shipment delays and fines. It also helps you avoid legal trouble. This keeps your business safe and running well.

Companies should check for new PCBA HS codes often. They should also work with customs experts. This helps them avoid mistakes and follow the rules.

Correct PCBA HS codes help lower costs and make customs faster. They also build trust with partners and buyers all over the world.

What Is a PCBA HS Code?

Definition

A PCBA HS code is a special number for printed circuit board assemblies in world trade. The World Customs Organization, or WCO, makes the rules for this system. More than 200 countries use it to sort products for buying and selling between countries. The code has six numbers that are the same everywhere. Some countries add more numbers for extra details. Each part of the code tells what kind of product it is, like bare boards or boards with parts on them.

The HS code system works like a tree. The first two numbers show the chapter, such as Chapter 85 for electrical machines. The next two numbers give the heading, like 34 for printed circuits. The last two numbers add more details. Some countries use even more numbers for better sorting.

Here is a table that shows how different PCB products fit into the HS code system:

PCB Product Category | HS Code(s) | Description and Notes |

|---|---|---|

Bare Printed Circuit Boards | 85340090 | Bare rigid PCBs with no parts, including double-sided, multilayer, flexible, and rigid-flex boards. |

85349010 | Multilayer PCBs with three or more layers that conduct electricity. | |

85340011 | Flexible PCBs with at least one layer that conducts electricity. | |

Assembled Printed Circuit Boards | 85177090 | Assembled PCBs with parts, including rigid and rigid-flex types. |

85176290 | Assemblies with expensive parts like processors. | |

Loaded PCB Assemblies in Housing | 84733090 | PCB assemblies put inside electronic cases or finished products. |

Relevance

The pcba hs code is very important in electronics trade around the world. Customs workers use these codes to set taxes, check rules, and see if a product can enter the country. Using the right code helps companies avoid late shipments, fines, or having their goods taken away. Trade numbers also use these codes to watch how electronics move between countries.

The HS code system helps with customs checks, tax amounts, and following the law.

Governments and world groups use HS codes to study trade and make rules.

Picking the right code helps companies plan money and lower risks.

For example, in India, HS code 85340000 for empty printed circuit boards was used in over 30,000 shipments. Many importers and exporters were involved. This shows why picking the right code is needed for easy trade.

PCBA HS Code by Country

India

India has a few main codes for printed circuit board assemblies. The most used code is 8534.00.00. This code is for bare printed circuit boards. Indian customs puts this code in Chapter 85. Chapter 85 is for electrical machines and equipment. Many people in India use this code for lots of shipments every year. Trade data from Volza shows 8534.00.00 is the top code for bare PCBs. This is true for products from China and Hong Kong. These shipments often have bare PCBs for cameras and mobile phones.

Another important code is 85177090. This code is for assembled PCBs and mobile phone parts. Indian customs uses this code for rules and taxes. Shipment records from many places show 85177090 is a key code for PCBA imports. The United Nations Commodity Trade Statistics Database and Moaah help check these codes. They give official trade numbers and customs rules for India. These sources show India uses 8534.00.00 for bare boards and 85177090 for assembled PCBA products.

Note: India changes its pcba hs code information often. Trade databases update this data every month or every 45 to 60 days. Importers and exporters must check for new updates to avoid mistakes.

Main PCBA HS Codes for India:

8534.00.00 – Bare printed circuit boards

85177090 – Assembled PCBs and mobile phone parts

8542.31 – Electronic integrated circuits and microassemblies

USA

The United States uses different codes for PCBA products. The main code is 8534.00.00. This code is for printed circuits. It matches the international system. It is used for both bare and assembled boards. Another code, 8504.90.6500, is for parts of transformers and similar devices. Some PCBA products use this code if they are part of a bigger assembly.

U.S. Customs and Border Protection has strict rules for PCBA imports. Importers must give clear product details and technical papers. The U.S. government updates its HS code list often. Companies must keep up to avoid delays or fines at customs.

USA PCBA HS Code | Description |

|---|---|

8534.00.00 | Printed circuits (bare or assembled) |

8504.90.6500 | Parts for transformers and similar devices |

Tip: U.S. importers should check the Harmonized Tariff Schedule and talk to customs brokers for the latest pcba hs code updates.

Indonesia

Indonesia uses special codes for PCBA products. The main codes are 84733010 and 84198913. Code 84733010 is for parts and accessories for data processing machines. This includes many PCBA types. Code 84198913 is for machinery parts not listed elsewhere. It is sometimes used for special PCBA assemblies.

Indonesian customs may sort PCBA products in different ways. It depends on how they are used or put together. Importers must give clear product details and technical facts. Indonesia updates its HS code list often. Companies must check for changes before shipping.

Key PCBA HS Codes for Indonesia:

84733010 – Parts for data processing machines (includes PCBA)

84198913 – Machinery parts, not elsewhere specified

Note: Data from world trade databases shows HS code information changes fast. Over 90 countries, including Indonesia, update their codes every month or every 45 to 60 days. This means it is important to have the latest pcba hs code information.

Key Differences

Code Comparison

Countries use different PCBA HS codes and rules. India, the USA, and Indonesia each have their own system. These differences change how companies ship and report their goods. The table below lists the main codes and how each country sorts PCBA products:

Country | Main HS Codes Used | Classification Focus | Extra Digits/Notes |

|---|---|---|---|

India | 8534.00.00, 85177090, 8542.31 | Bare PCBs, assembled PCBs, integrated circuits | 8-digit codes, frequent updates |

USA | 8534.00.00, 8504.90.6500 | Printed circuits, transformer parts | 10-digit HTS codes, strict rules |

Indonesia | 84733010, 84198913 | Data machine parts, machinery parts | 8-digit codes, use by function |

Volza’s trade data shows HS code 8537 is used for PCBA and similar parts. It appeared in 88 shipments across 16 countries from September 2023 to August 2024. The United States, Thailand, and China shipped the most. This information helps companies see how different places use PCBA HS codes.

Countries add extra numbers to the basic six-digit code. The USA uses 10-digit codes for more details. India and Indonesia use 8-digit codes. These extra numbers help customs officers set taxes and rules for each shipment.

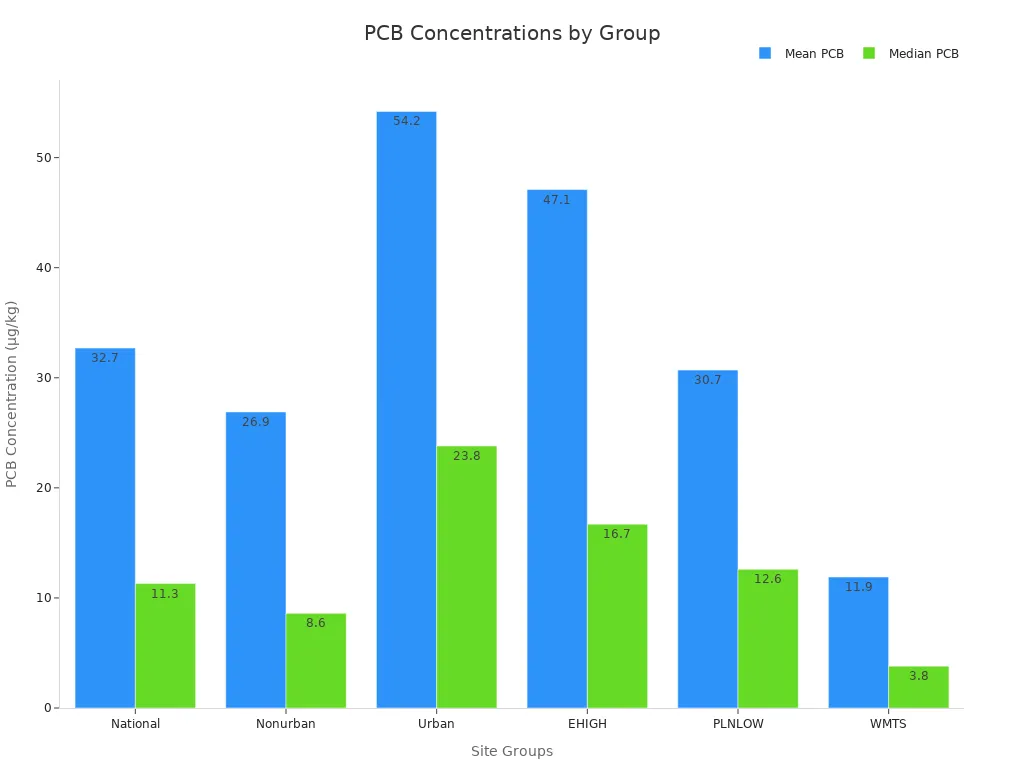

Government reports show that PCBA classification differences match local trade and industry patterns. Urban places often have more PCBs in products and the environment. This matches higher shipment numbers and stricter rules in countries with big electronics industries.

Regulatory Impact

HS code differences do more than change numbers on forms. They affect how companies follow laws, pay taxes, and handle risks. Customs officers need detailed papers for every shipment. Companies must show certificates of origin, value records, and technical details to prove the right pcba hs code. If a company uses the wrong code, it can get fines, delays, or lose the right to trade.

Customs rules make clear steps for PCBA classification:

Companies must show how much value they add to a product.

They must follow anti-circumvention rules to stop tariff cheating.

They need to use the right price methods for taxes.

Some trade programs give lower tariffs, but only with the right code.

Regulatory and tariff effects include:

HS codes help customs check shipments faster and with fewer mistakes.

Governments use these codes to collect trade data and make rules.

The right code gives the correct duty rate and avoids penalties.

Accurate codes let companies get tariff exemptions under trade deals.

Proper classification lowers the risk of fraud and mistakes.

Using the right pcba hs code cuts paperwork and helps manage risks.

Countries update their codes and rules often. India and Indonesia change their lists every month or two. Companies must check for new updates before shipping. Not following the rules can cause money loss, shipment delays, and hurt a company’s reputation.

Customs officers now use digital systems to check documents and track rules. Companies with good digital records can react faster to changes and avoid costly mistakes.

Why It Matters

Customs and Tariffs

Customs officers use the pcba hs code to set taxes. Each country has its own tax rates. These can be based on how many items there are, or on the value of the product, or both. Customs bonds are also important. If the tax is more than the bond, goods cannot enter the country. Using the right code helps companies pay the right amount. It also stops delays at customs. Almost all world trade uses the Harmonized System. This shows how important it is for business. The right HS code can help companies get lower taxes with trade deals.

Correct HS codes mean the right tax is paid.

Good classification helps goods move faster through customs.

Companies can get lower taxes if they use the right code.

Mistakes can cause extra storage costs or stop shipments.

Compliance Risks

Using the wrong HS code is risky. Customs may stop shipments, give fines, or ban products if codes are wrong. Wrong codes can also lead to fraud checks. Companies must show clear papers, like where the product is from and what it is made of, to prove the code is right. Not following the rules can slow down supply chains and hurt a company’s name.

Wrong codes can bring legal trouble and slow shipments.

Customs might check or hold goods for more review.

Companies could lose trade deals and special programs.

Business Impact

The right pcba hs code helps companies grow and save money. Good classification stops companies from paying too much tax. It also lowers shipping costs. It helps build trust with customs and partners. Using the right code lets companies ship goods on time and keeps supply chains working well. Companies that use the right codes can do better in world trade.

Right codes stop extra payments and fines.

Good classification helps goods clear customs faster.

Companies can get special low tax rates.

Being right all the time makes companies look good to buyers.

Spending time on HS code accuracy saves money and helps companies do better around the world.

Staying Compliant with PCBA HS Code

Verification Tips

Companies need to check the right pcba hs code before they ship. They should look at the product’s details and compare them to the Harmonized System. It is important to know what the product does and how it is put together. This helps pick the correct code. Many companies ask customs brokers for help. These experts know about new tariff rules and customs changes. They help companies avoid mistakes and fines. Training workers on new rules also helps companies follow the law.

Tip: Always check the product’s look and use with the newest customs lists. Doing this helps stop mistakes and keeps shipments on time.

Resources

Good resources help companies keep up with pcba hs code rules. Volza gives trade data every month about PCBA exports. This data shows shipment facts, product types, and trade numbers for each country. Companies use this to watch market changes and check their codes. The Harmonized Tariff Schedule and customs websites give official code rules. Some groups pay for trade data, but free samples are often online.

Resource | What It Offers |

|---|---|

Volza | Global trade data, shipment trends, HSN codes |

Customs Broker | Expert advice, compliance updates |

Harmonized Tariff Schedule | Official code definitions and updates |

Customs Authority Sites | Country-specific rules and news |

Best Practices

Importers and exporters should use clear steps to follow the rules. They need to make products that meet standards like FCC or EMC. Good assembly and paperwork help pick the right code. Companies should check and update HS codes often, since rules can change every few years. Keeping good records and following customs rules stops audits and fines. Working with customs brokers and teaching staff helps companies stay compliant.

Use the right tariff code for every shipment.

Update codes when products change.

Keep good records for all shipments.

Make sure products and assembly meet the rules.

Treat tariff codes as a key part of business.

Being careful with codes and paperwork saves money and keeps shipments moving without problems.

India, the USA, and Indonesia all use their own pcba hs code systems. These differences change how companies deal with customs and taxes. They also affect how companies follow the rules. Picking the right code for each country is important. It helps companies avoid delays, fines, or legal trouble.

Companies need to check for new updates often.

Good trade papers help business work well.

Knowing about pcba hs code changes keeps supply chains safe and helps companies grow around the world.

FAQ

What is the main PCBA HS code for India?

India uses 8534.00.00 for bare printed circuit boards. It uses 85177090 for assembled PCBs. These codes help customs officers know what is being shipped. They also help set the right taxes.

How often do countries update PCBA HS codes?

Most countries, like India and Indonesia, change HS codes every month or two. Companies should check customs websites for new updates. They can also ask customs brokers for help.

Can using the wrong HS code cause shipment delays?

Yes. If the HS code is wrong, customs may stop the shipment. This can mean extra costs or fines. Sometimes, companies can lose the right to trade.

Where can companies verify the correct PCBA HS code?

Companies can check the Harmonized Tariff Schedule or customs websites. They can also talk to licensed customs brokers for help. Volza and other trade data sites give updated code details.

Do PCBA HS codes affect import taxes?

Yes, they do. Customs officers use HS codes to set import taxes. The right code makes sure companies pay the correct amount. It can also help them get lower taxes with trade deals.

See Also

Why HS Codes Are Important For PCBA Components

Understanding HS Codes Assigned To PCBs And PCBAs

Unveiling Key Differences Between PCBA And PCB Boards